The Wall Street Journal tells how the CEO of Procter and Gamble is more interested in the storyteller than in the powerpoint slides. Therefore presentations should have powerful stories.

Mr. Atkinson suggests organizing your story into three acts and starting by establishing context. You want to let your audience know who the main characters are, what the background of the story is, and what you’d like to accomplish by telling it, he says. You might open, for example, by describing a department that’s consistently failed to meet sales goals.

Move on to how your main character—you or the company—fights to resolve the conflicts that create tension in the story, Mr. Atkinson says. Success may require the main character to make additional capital investments or take on new training. Provide real-world examples and detail that can anchor the narrative, he advises.

The ending should inspire a call to action, since you are allowing the audience to draw their own conclusions about your story versus just telling them what to do. Don’t be afraid to use your own failures in support of your main points, says Mr. Smith.

Whatever you do, don’t preface your story with an apology or ask permission to tell it. Be confident that your story has enough relevance to be told and just launch into it, says Mr. Smith. Confidence and authority, he says, help to sell the idea to your audience.

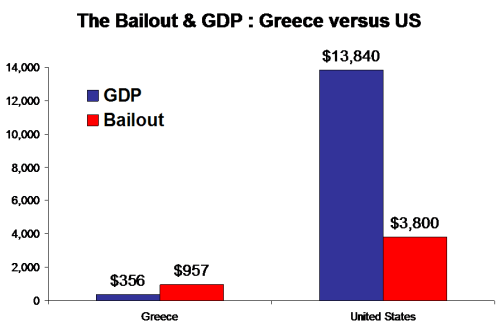

The idea here is not new. Humans are more receptive to stories than to data. The powerful message that was omitted, however, was that while people are more receptive to anecdotes than boring powerpoint presentations, good decisions are made based on information. A story backed up by data combines the power of human psychology with the power of knowledge.